.webp)

We are moving towards a future where innovative revenue streams flourish, enabling users to tap into opportunities previously unavailable.

In this interconnected ecosystem, consumers, businesses, and machines engage in value exchange effortlessly, bridging the digital realm and the brick-and-mortar world. Payments for services, whether it's unlocking a news article or paying for distance driven, will become so intuitive that you won't even need to reach for your phone.

Welcome to the future of value exchange through our lens at XRPL Labs.

The global transaction landscape is rapidly evolving. High-volume, low-value transactions are becoming the norm, emphasizing the need for cost-effective solutions.

The hassle of juggling different loyalty cards, each with points that may expire before you can use them. Or the inconvenience of using one app to make payments, another to save, and yet another to manage rewards. For retailers, the high costs of processing payments can eat into profits and limit business models.

We’re trying to create a world where all these fragmented experiences converge seamlessly. Whether it's paying for the exact amount of data you use or purchasing a single news article without a full subscription, we're making it a reality.

We're moving beyond just cryptocurrency; we're building on a decade of blockchain innovation. Now, we harness the best of this technology to empower every value exchange in our daily lives. As pioneers, we stand at the forefront, venturing boldly into uncharted territories.

“Innovation is about redefining what’s possible and executing it. Just as Sony led an evolution with the portable transistor radio, we're unlocking entirely new realms in payments, closing gaps and pioneering the future, offering effortless microtransactions with negligible fees, granting maximum flexibility and freedom in the world of payments." - Wietse Wind, CEO and Founder of XRPL Labs.

We are building a future where one solution becomes your gateway to everything of value. Beyond just money, it encompasses loyalty points, collectibles, access, fiat, credits, tokens, and more.

This open infrastructure for value is tailored for you, your friends, your family, and the brands you value. You're in control, moving beyond just cryptocurrency, harnessing the best of blockchain innovation to redefine daily transactions.

You have the freedom to tailor your experience to your preferences. Whether you decide to integrate with your existing bank, embrace consumer protection, or walk on a path independent of these options, the choice is yours. This ensures that you, and only you, dictate the terms of your financial preferences.

Opportunities lie in every challenge, and we are poised to capitalize on them. By harnessing the power of efficient payment systems, we're on the verge of unveiling business models previously thought impossible. These aren't just experimental ventures; they're strategic moves designed to redefine how businesses operate and consumers interact.

Take, for instance, a global brand that can now offer personalized digital loyalty programs, rewarding customers in real-time without needing physical cards, printed-out coupons, or cumbersome sign-up processes.

Our guiding principle is clear: prioritize innovation over imitation. We're not just following the path others have tread; we're carving out our own, setting new standards along the way.

Behind every grand vision lies a solid base. For XRPL Labs, that base is the rock-solid technology underpinning the XRP Ledger and Xahau. Xahau not only amplifies the strengths of the XRPL but also paves the way for our ambitious future endeavors.

While the XRPL excels in areas like liquidity, Xahau complements it, ensuring both systems communicate using the familiar protocol. This synergy allows us to develop and deploy our vision, aligning our present actions with our ambitious goals for the future.

Xahau elevates the XRP Ledger's capabilities by introducing Hooks, marking the next frontier of innovation with fast, secure, and cost-effective smart contract functionality.

These smart contracts execute swiftly, maintaining high-speed settlements. They enable the implementation of most business logic and smart contract ideas by adding intricate transaction conditions, enabling innovative recovery options, direct debit setups, and more, all while keeping users in full control.

Automation and Machine-to-Machine (M2M) payments are reshaping the very fabric of our financial systems. As the world's commitment to solutions such as clean energy, electric vehicles, and more grows, we need to rethink how standard value exchange models work.

An example is a service that offers electric cars, bikes, or scooters for hire, where users pay not through traditional rental agreements but based on the distance they travel. A swift and secure onboard system calculates your distance as you drive, seamlessly handling payments in the background.

Once your ride ends, you get a receipt and earn loyalty points for each eco-friendly mile, all while contributing to sustainability without a second thought.

While just an example, this is not a far-off dream; it's the power of fast, adapting, small machine-to-machine payments that can be set up ahead of time.

We are at the front of the pack and ready to make these transactions a normal part of our lives. This isn't just about making a transaction; it's about offering accessible, cheap, and safe solutions while shaping a greener, more sustainable future.

By enhancing these transactions, we're setting the stage for a new era of business-consumer interactions, where efficiency and user experience interact harmoniously.

The financial world stands at a pivotal juncture. Open banking, exemplified by the EU's PSD2 directives and the U.S.'s initiatives, leads the charge toward greater transparency and collaboration.

While the European Union has been pioneering this change with the rollout of PSD2 directives, the U.S. is making strides with its Open Banking initiatives. Combined with the growing momentum behind central bank digital currencies (CBDCs), we're on the brink of something new.

Together, these developments change how the world interacts with money and financial systems, pushing us toward a more integrated and transparent financial future.

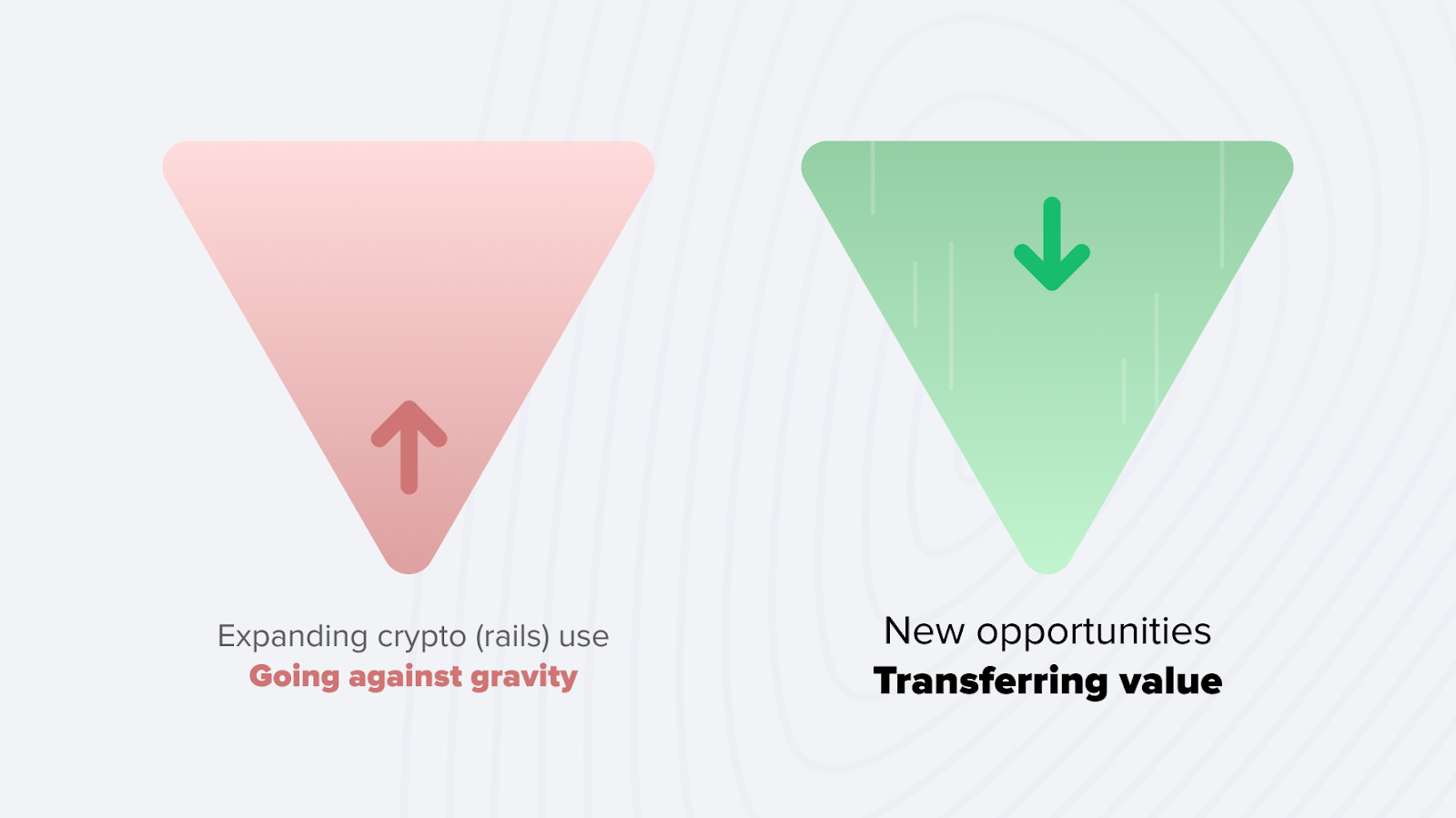

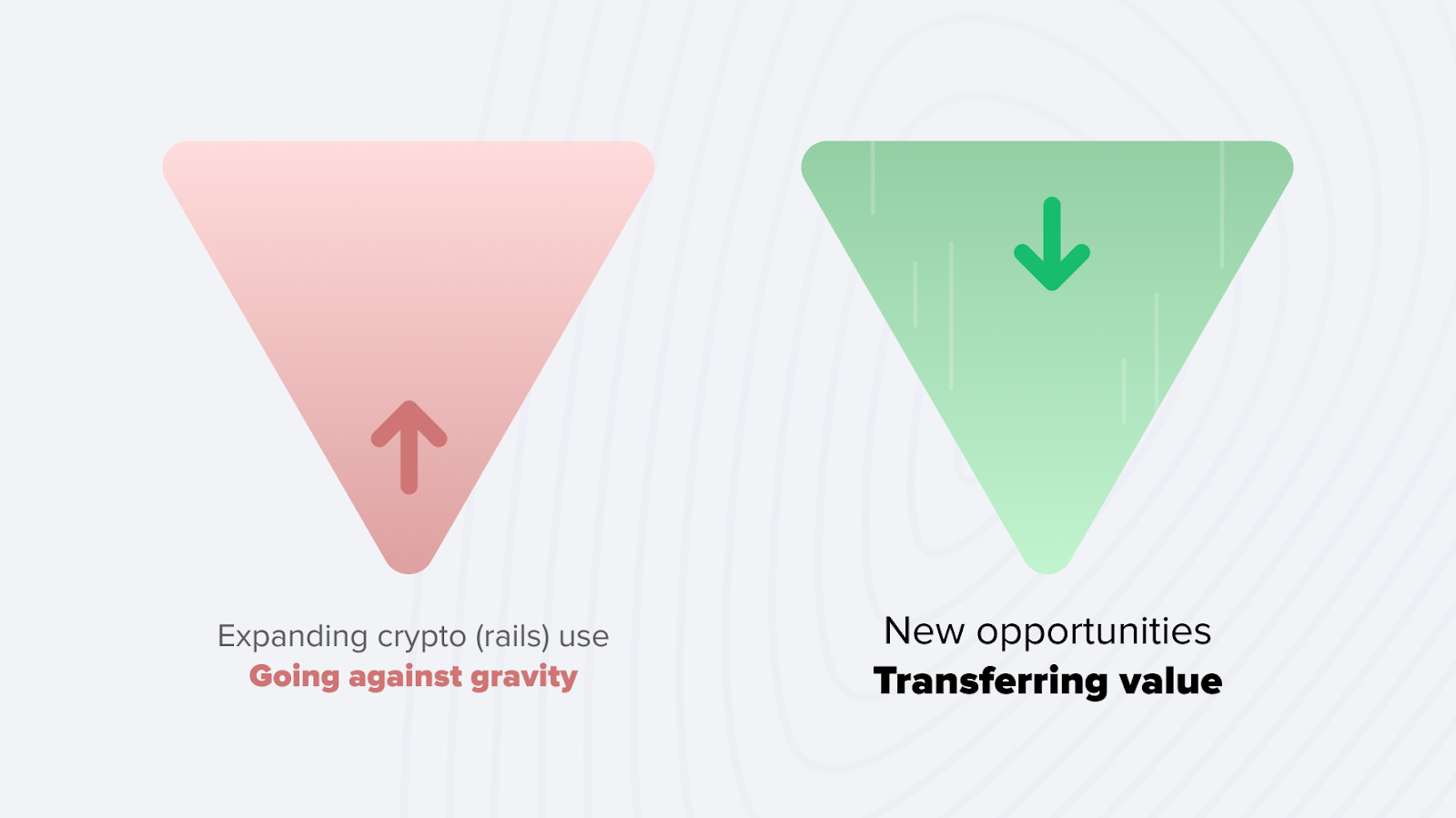

Embracing the Financial Renaissance isn't a battle of crypto versus traditional finance.

It's about crafting the optimal technology to facilitate value exchange. Beyond just laying the foundational tech, we're constructing the tools, layers, and applications businesses require to seize these opportunities.

"We're crafting the future of finance, not by doubling the efficiency of payments, but by unlocking entirely new realms. We focus on what hasn't been done, exploring uncharted opportunities and transcending traditional models. This is the end of "business as usual" and the dawn of a new era where traditional payments give way to previously unimaginable supercharged ways of value exchange." - Wietse Wind.

Our mission at XRPL Labs transcends technology. We're not just enhancing crypto or pioneering another fintech solution. We're erasing the lines between crypto, banking, fintech, and payment apps.

Together, we are at the beginning of a world where value exchange is as intuitive as breathing, where you don't have to ponder about the platform, currency, or technology behind each transaction. Businesses can effortlessly offer services regardless of the transaction's size, location, or nature of value.

What we're building isn't just another facet of banking or a new crypto trend. We're crafting a universal experience, seamlessly integrating every mode of value exchange.

As we embark on this ambitious journey, we extend a heartfelt invitation to you.

We are moving towards a future where innovative revenue streams flourish, enabling users to tap into opportunities previously unavailable.

In this interconnected ecosystem, consumers, businesses, and machines engage in value exchange effortlessly, bridging the digital realm and the brick-and-mortar world. Payments for services, whether it's unlocking a news article or paying for distance driven, will become so intuitive that you won't even need to reach for your phone.

Welcome to the future of value exchange through our lens at XRPL Labs.

The global transaction landscape is rapidly evolving. High-volume, low-value transactions are becoming the norm, emphasizing the need for cost-effective solutions.

The hassle of juggling different loyalty cards, each with points that may expire before you can use them. Or the inconvenience of using one app to make payments, another to save, and yet another to manage rewards. For retailers, the high costs of processing payments can eat into profits and limit business models.

We’re trying to create a world where all these fragmented experiences converge seamlessly. Whether it's paying for the exact amount of data you use or purchasing a single news article without a full subscription, we're making it a reality.

We're moving beyond just cryptocurrency; we're building on a decade of blockchain innovation. Now, we harness the best of this technology to empower every value exchange in our daily lives. As pioneers, we stand at the forefront, venturing boldly into uncharted territories.

“Innovation is about redefining what’s possible and executing it. Just as Sony led an evolution with the portable transistor radio, we're unlocking entirely new realms in payments, closing gaps and pioneering the future, offering effortless microtransactions with negligible fees, granting maximum flexibility and freedom in the world of payments." - Wietse Wind, CEO and Founder of XRPL Labs.

We are building a future where one solution becomes your gateway to everything of value. Beyond just money, it encompasses loyalty points, collectibles, access, fiat, credits, tokens, and more.

This open infrastructure for value is tailored for you, your friends, your family, and the brands you value. You're in control, moving beyond just cryptocurrency, harnessing the best of blockchain innovation to redefine daily transactions.

You have the freedom to tailor your experience to your preferences. Whether you decide to integrate with your existing bank, embrace consumer protection, or walk on a path independent of these options, the choice is yours. This ensures that you, and only you, dictate the terms of your financial preferences.

Opportunities lie in every challenge, and we are poised to capitalize on them. By harnessing the power of efficient payment systems, we're on the verge of unveiling business models previously thought impossible. These aren't just experimental ventures; they're strategic moves designed to redefine how businesses operate and consumers interact.

Take, for instance, a global brand that can now offer personalized digital loyalty programs, rewarding customers in real-time without needing physical cards, printed-out coupons, or cumbersome sign-up processes.

Our guiding principle is clear: prioritize innovation over imitation. We're not just following the path others have tread; we're carving out our own, setting new standards along the way.

Behind every grand vision lies a solid base. For XRPL Labs, that base is the rock-solid technology underpinning the XRP Ledger and Xahau. Xahau not only amplifies the strengths of the XRPL but also paves the way for our ambitious future endeavors.

While the XRPL excels in areas like liquidity, Xahau complements it, ensuring both systems communicate using the familiar protocol. This synergy allows us to develop and deploy our vision, aligning our present actions with our ambitious goals for the future.

Xahau elevates the XRP Ledger's capabilities by introducing Hooks, marking the next frontier of innovation with fast, secure, and cost-effective smart contract functionality.

These smart contracts execute swiftly, maintaining high-speed settlements. They enable the implementation of most business logic and smart contract ideas by adding intricate transaction conditions, enabling innovative recovery options, direct debit setups, and more, all while keeping users in full control.

Automation and Machine-to-Machine (M2M) payments are reshaping the very fabric of our financial systems. As the world's commitment to solutions such as clean energy, electric vehicles, and more grows, we need to rethink how standard value exchange models work.

An example is a service that offers electric cars, bikes, or scooters for hire, where users pay not through traditional rental agreements but based on the distance they travel. A swift and secure onboard system calculates your distance as you drive, seamlessly handling payments in the background.

Once your ride ends, you get a receipt and earn loyalty points for each eco-friendly mile, all while contributing to sustainability without a second thought.

While just an example, this is not a far-off dream; it's the power of fast, adapting, small machine-to-machine payments that can be set up ahead of time.

We are at the front of the pack and ready to make these transactions a normal part of our lives. This isn't just about making a transaction; it's about offering accessible, cheap, and safe solutions while shaping a greener, more sustainable future.

By enhancing these transactions, we're setting the stage for a new era of business-consumer interactions, where efficiency and user experience interact harmoniously.

The financial world stands at a pivotal juncture. Open banking, exemplified by the EU's PSD2 directives and the U.S.'s initiatives, leads the charge toward greater transparency and collaboration.

While the European Union has been pioneering this change with the rollout of PSD2 directives, the U.S. is making strides with its Open Banking initiatives. Combined with the growing momentum behind central bank digital currencies (CBDCs), we're on the brink of something new.

Together, these developments change how the world interacts with money and financial systems, pushing us toward a more integrated and transparent financial future.

Embracing the Financial Renaissance isn't a battle of crypto versus traditional finance.

It's about crafting the optimal technology to facilitate value exchange. Beyond just laying the foundational tech, we're constructing the tools, layers, and applications businesses require to seize these opportunities.

"We're crafting the future of finance, not by doubling the efficiency of payments, but by unlocking entirely new realms. We focus on what hasn't been done, exploring uncharted opportunities and transcending traditional models. This is the end of "business as usual" and the dawn of a new era where traditional payments give way to previously unimaginable supercharged ways of value exchange." - Wietse Wind.

Our mission at XRPL Labs transcends technology. We're not just enhancing crypto or pioneering another fintech solution. We're erasing the lines between crypto, banking, fintech, and payment apps.

Together, we are at the beginning of a world where value exchange is as intuitive as breathing, where you don't have to ponder about the platform, currency, or technology behind each transaction. Businesses can effortlessly offer services regardless of the transaction's size, location, or nature of value.

What we're building isn't just another facet of banking or a new crypto trend. We're crafting a universal experience, seamlessly integrating every mode of value exchange.

As we embark on this ambitious journey, we extend a heartfelt invitation to you.